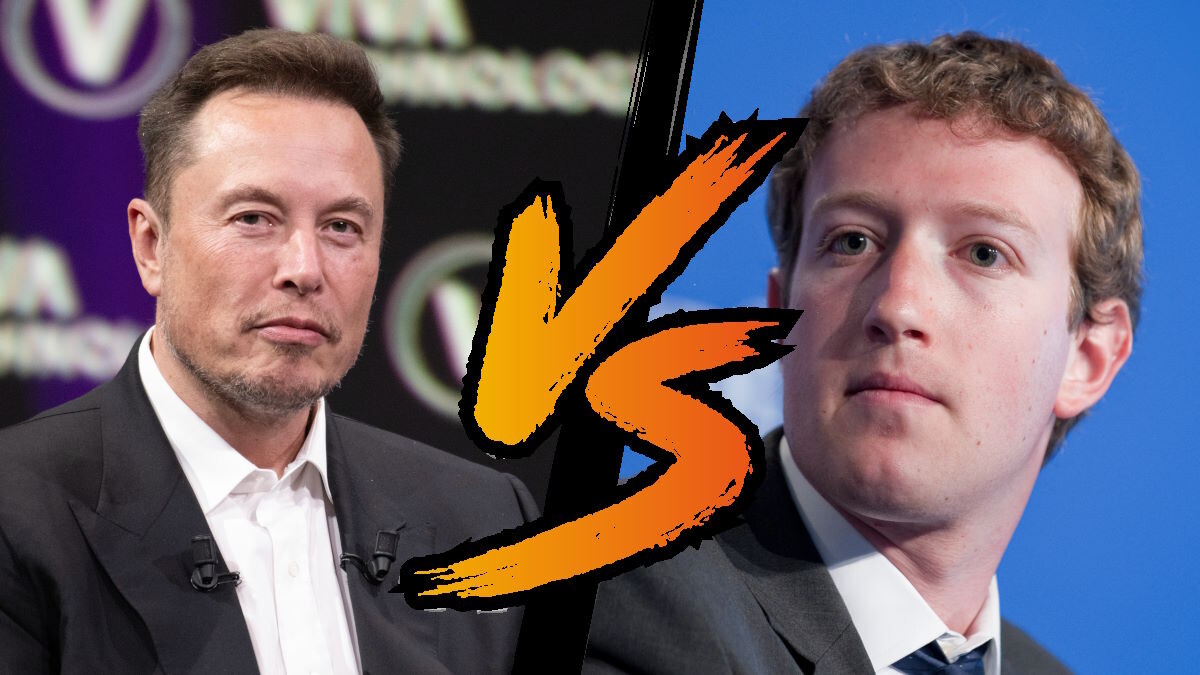

Elon Musk Calls for 2018 Shareholder Lawsuit Location Change

January 22, 2023

Elon Musk, the Tesla CEO, SpaceX founder, and tech billionaire, is still in the work of sorting out a financial lawsuit from 2018, amidst major losses from his newest acquisition of Twitter.

On Tuesday, August 7, 2018, Musk surprised investors by tweeting that he was considering turning Tesla into a private company, stating “Am considering taking Tesla private at $420. Funding secured,” along with”Investor support is confirmed” later that day. The plaintiffs of each of these two lawsuits are

and William Chamberlain, with Isaacs arguing for class between August 7th and 8th, with Chamberlain arguing for a class between the 7th and 10th. Both plaintiffs are suing on the basis that, through an irresponsible tweet, Musk created artificial inflation in Tesla’s stocks, which they argue breaks federal securities law.

Additionally, Isaacs contends that Musk intentionally tweeted this unexpected information in order to harm short-sellers. By definition, short-sellers are people who borrow overpriced shares, sell them, and then try to rebuy at a lower price in order to make a profit. Musk has criticized this group of investors frequently on Twitter, pointing to the possibility of targeting them with his Tesla tweet.

Musk’s tweets did, nevertheless, have a substantial impact on the market, as shares rose 13% above the end of the previous day on August 7, 2018, with a subsequent drop by about two-thirds of the initial rise, likely due to a U.S. Securities and Exchange Commission investigation of the issue. Still, both Chamberlain and Isaacs argue that Musk forced short-sellers to cover their positions and caused inflation in prices for securities investors. Isaacs himself even bought 3,000 shares on the 8th of August in order to account for his own short position. This is on top of the fact that, at the time of the lawsuit filings, Musk was unable to procure evidence that he even had the funding to turn Tesla into a private company.

The cases are officially titled Isaacs v Musk et al, U.S. District Court, Northern District of California, and Chamberlain v Tesla Inc et al, which will occur at the same court. While litigation has taken quite a while, Edward Chen, a U.S. District Judge ruled during the May 2022 proceedings that Musk’s tweets were false information, although it still must be determined by jury the significance of the reckless tweets to investors and Tesla Stock. Trials of this type are a rare occurrence as well, making Musk’s case quite unique. According to Cornerstone Research, only about 1% of shareholder class action lawsuits were actually tried to a final verdict between 1997 and 2018.

As Musk and Tesla Inc are finally slated to meet a jury trial in early January of 2023, Musk made claims that the trial must not occur in the Bay Area of California. Instead, the billionaire wants the proceedings moved into West Texas, which happens to also include the city of Austin, where he moved the headquarters of Tesla to in 2021. Referring to the San Francisco area, Musk’s attorney Alex Spiro wrote in a court filing that, “For the last several months, the local media have saturated this district with biased and negative stories about Mr. Musk.” Several other points were also noted, including mentions of several news articles that set Musk as directly accountable for the recent layoffs of more than 7,500 Twitter workers after its acquisition. Not only do these articles, Spiro claims, indicate that Musk violated the law by laying off workers, but the area where the trial is set to take place is home to around 1,000 of those employees, creating a somewhat tense environment. Even if Musk is unable to move the trial, it is likely to continue being delayed until news coverage of Musk’s issues with Twitter resolves to some extent.