The Trump administration has been busy, issuing an unprecedented number of executive orders since the inauguration in January, and working with the Republican-controlled Congress to pass a federal budget with massive spending cuts. But while the mass firings of federal workers and ending of key government programs with threats to Medicare and Social Security are monumental, a different economic policy has grasped more media attention, and may potentially have a more immediate impact: tariffs.

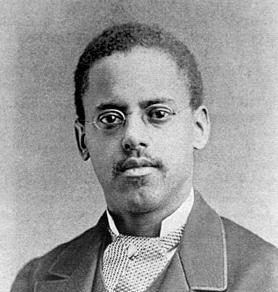

Trump made clear throughout his campaign that tariffs were a major goal of his, and has essentially idolized former President William McKinley, who signed the Tariff Act of 1890, increasing barriers across all imports from between 30 to 50%. Trump has labeled McKinley the “tariff king” in various rally speeches and addresses, as he promised to implement additional barriers on Canada, Mexico, China, and even some European countries.

But what is a tariff? The official definition is “a tax or duty to be paid on a particular class of imports or exports”, which essentially means that any foreign party exporting goods into the United States must pay an additional fee to the U.S. government. The common misconception is that the trading partner’s government pays the fee, which is inaccurate. In reality, the business importing the good to the U.S. faces the charge, which in turn means they raise costs on the goods themselves to balance things out, meaning consumers see higher prices. Almost all economists universally agree that American consumers will see a “sticker shock” effect and higher prices on a wide variety of goods. NPR found that Trump’s originally proposed tariffs, 10% on China, and 25% on Canada and Mexico, could cost consumers up to $800 extra in 2025 alone.

But that isn’t even considering the retaliatory tariffs levied on the U.S. by China, the largest exporter of goods purchased in the U.S. With Trump now promising even more tariffs as soon as March 4th, a Chinese Ministry of Commerce spokesperson said in a statement that “China will take all necessary countermeasures to defend its legitimate rights and interests”. You may not see prices increase immediately, but they will all but certainly go up over time. It’s important to note that a 10% tariff on China doesn’t immediately translate into a 10% price increase on Chinese goods.

So why is Trump pursuing tariffs? Because, in his words, “it’s going to make our country a fortune”. He has also speculated that his administration will be able to replace the federal income tax with tariff revenue, a claim that the Trump team has yet to provide evidence for. But clearly, Trump is hoping to be the next iteration of William McKinley, and the second “tariff king” President. Whether that strategy ultimately pays off is to be seen, but even Trump himself has acknowledged that there will be “growing pains” and consumers will face higher costs for now.