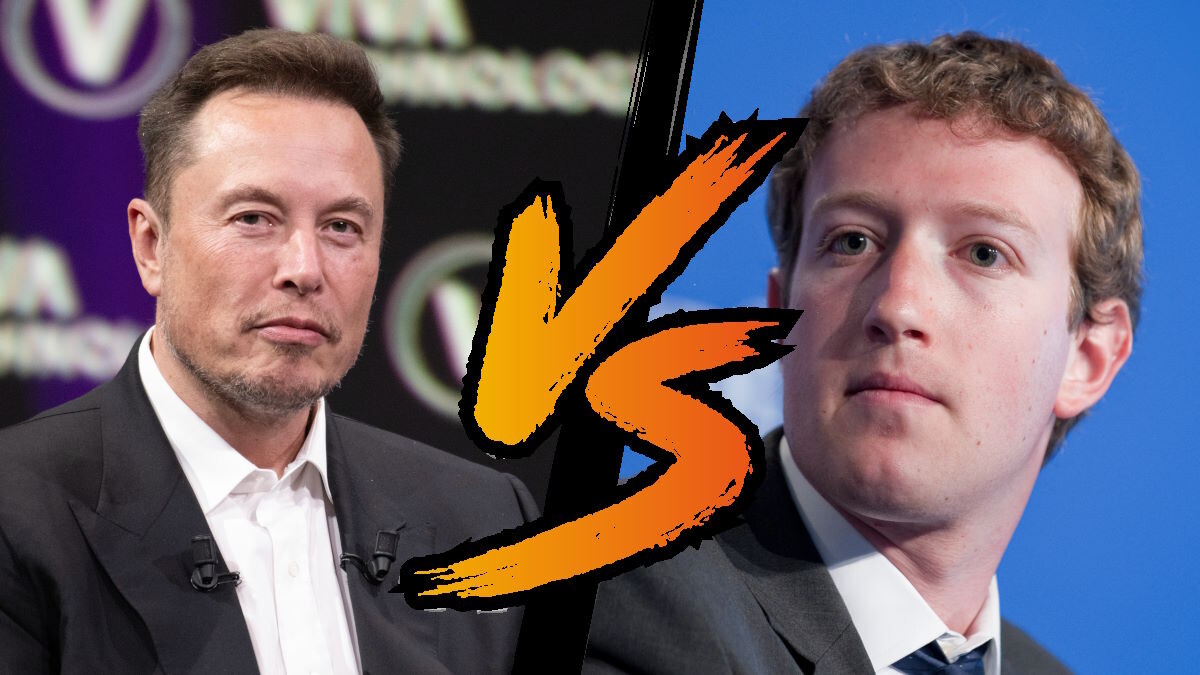

Elon Musk Under Legal Pressure With Twitter Deal

October 27, 2022

Elon Musk, one of the richest individuals on the planet, recently had a lawsuit filed against him by Twitter after a rescinded deal to buy the Social Media giant earlier this year.

The process of Musk considering the purchase of Twitter began in late March of 2022, with the multi-billionaire making initial contact with Jack Dorsey, Twitter’s founder, discussing several options he might have in terms of involvement with the company. About a week later, Musk made an announcement on April 4, 2022, that he had purchased a massive 9.2% of Twitter’s stock, valued at around $2.89 billion. This was followed by an offer filed to the United States Securities and Exchange Commission (SEC) by Musk to buy the company outright for approximately $43 billion, the equivalent of $54.20 per share. Initially resisting this attempted purchase, Twitter enacted a defensive measure, a corporate move intended to stop Musk from buying it, which was quickly reversed, as Twitter agreed to a $44 billion dollar purchase.

Initially, after this deal was made, Elon Musk announced some of his plans for the company, including the possibility of removing permanent bans, such as that of former President Donald Trump, along with reducing the removal of sensitive content from the platform. However, Musk’s acquisition of the company was “temporarily on hold” after he decided to research more into Twitter’s estimate that less than 5% of users were bots, spam, and fake accounts. In a tweet by Twitter CEO Parag Agrawal announcing this statistic, Musk responded with a poop emoji, along with claiming that the social media platform likely consists of 20% bots, in his opinion. This was followed by a statement that his deal with Twitter “cannot move forward,” as Musk continued to question the number of fake accounts provided by the company.

Although Twitter still planned on closing and enforcing the merger deal, Musk continued to delay. Resultantly, in late May, the SEC began an investigation into an early disclosure of ownership by Musk of Twitter, taking issue with both the form type used by Musk for the potential transaction, along with the share price changes resulting from Musk’s announcement of an initial takeover offer. Then, on June 3rd, Twitter announced the ending of the U.S. antitrust waiting period for the purchase, meaning that, with the vote of stockholders, among other processes, the deal could still go through. Musk shot back a response, saying that he had a “right to terminate the agreement.” In spite of these disagreements between the social media company and the billionaire, Musk gained data regarding all current public tweets, representing somewhat of an exchange in power, although some major companies involved in advertising already have this information as well.

Eventually, on July 8, 2022, Musk officially attempted to stop the $44 billion dollar deal with Twitter, citing a failure to meet contractual obligations as the reason behind this breaking off. Despite Musk’s attempts to stop the legal action, Twitter responded by suing Musk, a case intended to be heard in the Delaware Chancery Court. Arguments ensued with Musk subpoenaing Jack Dorsey, former CEO, and a co-founder of Twitter, to the court case for specific documents, still hoping to break off the deal. However, Twitter shareholders, in a meeting on September 13th, voted in favor of Musk purchasing the company for the intended $44 billion, prompting Musk to issue a letter proposing the closure of a merger deal worth the initial $54.20 per share.

Now, after a specific request from Musk, although the case was scheduled for October 17, 2022, the judge decided to postpone the disputed case until October 28th. In comments from Musk’s attorney, Alex Spiro, claims were made that Twitter is trying to deal with other issues under the law, as Pelter Zakto, the company’s former head of security, recently filed a whistleblower complaint about the lack of security within the social media platform. This prompted a federal investigation of several Twitter executives, with the Federal Trade Commission getting involved; although, they refused to publicly disclose information about the case. Twitter, however, issued a statement that it did not in fact demand that Zakto burn several notebooks of information as part of his separation from the company, contrary to what Elon Musk’s legal team had previously claimed. In terms of Musk’s case, this new investigation into the general security of Twitter could not only postpone the case of the billionaire buying Twitter but could also swing the proceedings in Musk’s favor.